Death for sale: advertising funeral services

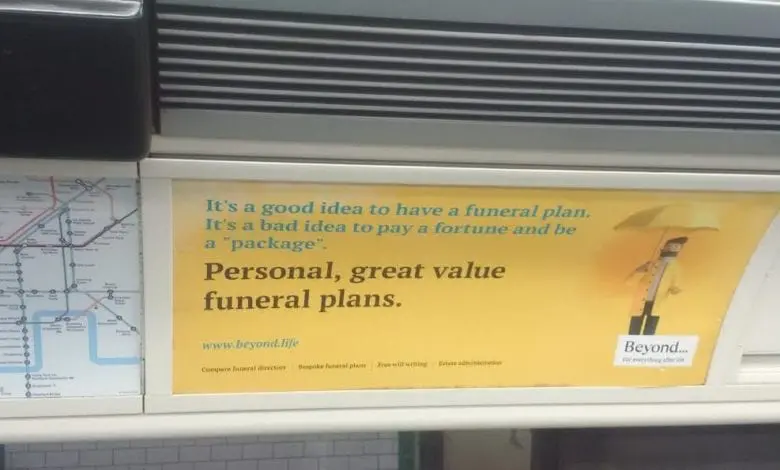

“So, these adverts are a tad edgier, and that’s deliberate,” said funeral comparison site Beyond in defence of a series of tube adverts which provoked a media storm. The adverts in question were disguised as adverts for other services and products such as holidays, medication, weddings and loans.