Register to get 2 free articles

Reveal the article below by registering for our email newsletter.

Want unlimited access? View Plans

Already have an account? Sign in

Due to the Coronavirus pandemic, the world’s economy has shuddered to a halt under mass enforced country lockdowns which froze globally intertwined supply chains, the world’s stock markets fell, and the London Stock exchange saw the value of stocks disintegrate at unprecedented levels. With the FTSE falling from 7503 on the 5 February by over 2,500 points to just 4993 on the 22 March, the market tumbled to levels only previously seen after the global banking crisis of 2009.

The impact on the Pre-Need sector

For the pre-need sector, the arrival of COVID-19 could not have come at a worse time, as the Pre-need market has been desperately trying to weather the storm of successive market shocks since 2017. On top of this, it still hadn’t fully recovered from the trading inertia caused by political unrest, increased regulatory governance and the lack of consumer confidence driven by negative media attention and the well-publicised decision by HM Treasury to place the industry under direct FCA regulation.

The growth of the market slowed rapidly, with sales decreasing year on year since the 2016 industry high of 210,700 falling to 165,200 recorded plan sales in 2020, a drop of -22%. Whilst the market adapts to the demands and rigour of a new FCA rule book throughout 2022, undoubtedly the pre-need market will continue to contract even further.

This crisis has of course had a substantial impact on the funeral planning sector and the wider funeral industry, as it has with many sectors. But specifically, in terms of the combined funeral sector, it is possible that in the short to medium term, this pandemic may just be the singular catalyst that proves to be the sector’s reputational saviour.

Re-thinking the way we sell to customers.

Traditionally, most funeral plans in the market have been sold by way of face to face interactions, whether in the funeral home, home appointments or by way of strategic affinity partnerships. With the current lockdown in place, at least two of the usual channels to market for distribution have been completely disrupted and with the real probability that the first wave of the virus may not be a distinct episode, alternative approaches will need to become a more permanent fixture going forward.

The Pre-need industry has had to adapt and swiftly embrace new technologies and remote working strategies. Most had already developed this as part of their business continuity planning, specifically based on a workplace becoming unsuitable or because of the loss of a critical service and are now testing them out in real time.

However, the plans that we had built here at Golden Leaves, like almost all other businesses, were based on short term disruption scenarios. Covid-19 and social distancing has presented a very different set of challenges with far longer time frames, which will undoubtedly prove to be transformational.

What options do we have for selling during lockdown?

The advance of technology, its acceptance, and its widespread use by consumers in purchasing the full suite of end of life products and services, that we believed was over 5 years away, is now fully upon us.

Platforms such as Facetime, WhatsApp, Microsoft Teams and Zoom amongst other social media and digital engagement tools may all become common approaches when purchasing end of life products and Prepaid funeral plans, as well as being used for arranging at-need funerals. Online customer engagement and web-based purchases that always constituted a small fraction of most pre-need companies’ sales volume, will rise.

Telephony based interactions, consultations and selling, will once again re-emerge as a credible and reliable distribution model, providing the correct data consent and sales controls are in place and robustly monitored.

The survival of pre-need businesses during the outbreak and in the aftermath of it, will be as much about adaptability and the ability to accommodate changes in consumer behaviour, as it will be about core leadership.

Instilling confidence

The implementation of modern and professional standard quality management, processes and governance systems are now paramount to business success and survival in the pre-need sector. As FCA regulation approaches, never has it been more important for us to instil confidence in both consumers, strategic partners, and funeral businesses alike.

The eventual introduction of Authorised Representative or Introduced Authorised Representative distribution models across the industry will heap a substantial amount of management, demonstrable governance and reporting pressure on all principle Funeral planning companies. Ensuring they have the both the correct operational systems and qualified staff in place, underpinned by a mature and robust Trust fund which is financially strong enough to withstand market shocks, will be an absolute necessity.

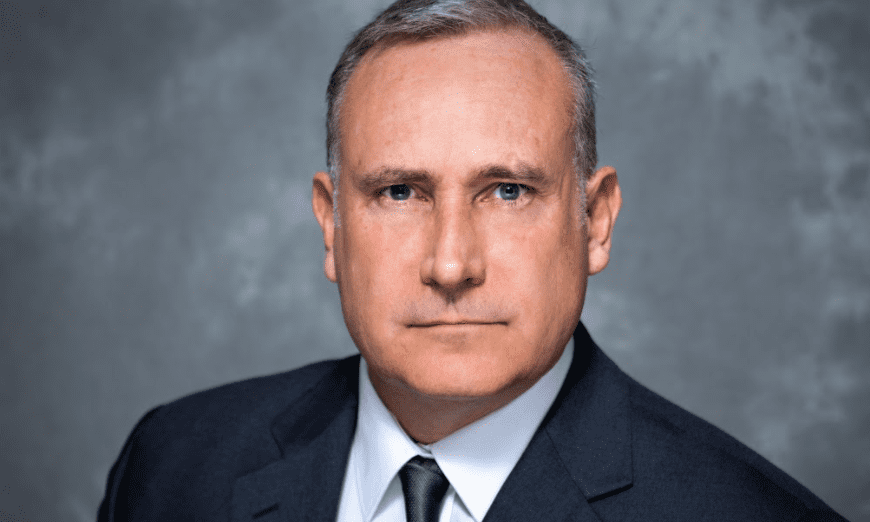

The importance of consistent leadership

Even facing the COVID-19 pandemic, some of the same considerations to a business’s success that existed beforehand are just as relevant now and one of these is consistent leadership as the industry is faced with such unstable times.

The businesses vision, strategic planning, integrity, focus, courage and co-operation remain stable leadership qualities required for business success. Over the last few years, we have seen widespread changes in leadership and ownership across almost every single pre-need company in the sector other than Golden Leaves. This stable leadership is pivotal to delivering consumer and sector confidence in both a brand’s core values and it’s products.

But any true mark of success, will only be judged by how the public’s perception of the sector alters once the crisis is over, specifically as the media has constructed a negative public perception of the entire sector over recent years.

The challenge of delivering funerals

Delivering funerals during this unprecedented time of social distancing has brought unexpected challenges and restrictions to the actual delivery of at-need and maturing pre-need funerals too. Having to consider the health and safety of their own staff, as well as mourners, with so little definitive guidance from the government, funeral businesses and crematoria have had to interpret the guidelines with some less than favourable consumer outcomes.

Some businesses have decided to stop supplying limousines altogether and some crematoria have decided to only allow unattended cremations.

These direct cremations have obviously caused considerable upset to many bereaved families and will have undoubted effects on the grieving process. Despite this type of unattended service, rapidly growing in popularity pre-COVID-19, it is entirely probable that now the general public have witnessed the issues it presents bereaved individuals, its attraction may well begin to wane.

The aftermath

Everyone who lives through these unprecedented times will remember them for varying reasons: From the Joe Wicks morning workouts, food shortages, empty roads and towns and queuing at supermarkets, to the devastating fallout of losing their businesses, jobs or homes.

But for many, the harsh reality of this pandemic will be the loss of loved ones and the undeserved, restrictive funeral service that was not the farewell they would have chosen.

As well as the dedicated frontline NHS staff, the Funeral businesses across the country will remember how they served the nation, selflessly, at their own risk, and witnessed the heartbreak for themselves each day.

Let’s hope that the selflessness the funeral industry has shown in the face of this pandemic will earn it the respect it deserves and that the sector will gain some recognition and approbation from the national media rather than just the usual criticism.